Blockchain Edge Data Analytics

Blockchain Edge Data Analytics

So, VTI, huh? The Vanguard Total Stock Market ETF. Sounds legit, right? Like you're getting a slice of everything. But let's be real, folks. "Total" in whose universe?

Up 13% year-to-date? Okay, cool. So is my neighbor's chihuahua after he found that discarded donut. Doesn't mean it's a sound investment strategy. And down 1.74% over the past five days? Anyone surprised? Anyone?

The TipRanks Black Friday sale... Give me a break. Is this supposed to inspire confidence? "Hey, the market's volatile, but buy our premium service so you can feel like you know what's going on!" It's the financial equivalent of selling umbrellas during a hurricane.

Let's dissect this "total" market claim, shall we? They're patting themselves on the back because it's up 0.21% in pre-market trading? Newsflash: my morning coffee is also "up" after I pour the milk in. Doesn't mean it's going to solve world hunger.

And the top holdings... Nvidia (NVDA), Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Broadcom (AVGO). Oh, how diverse. It's like they just copy-pasted the holdings of every other tech-heavy ETF and called it a day. If I wanted to bet on the same five companies everyone else is drooling over, I'd just buy their stocks directly. Why pay Vanguard a fee to do what I can do with one hand tied behind my back?

4. 06 million shares average trading volume... okay, that's decent liquidity. But $336 million in net inflows over five days? That's just noise. A rounding error in the grand scheme of things. People chasing performance, as always. Sheep to the slaughter.

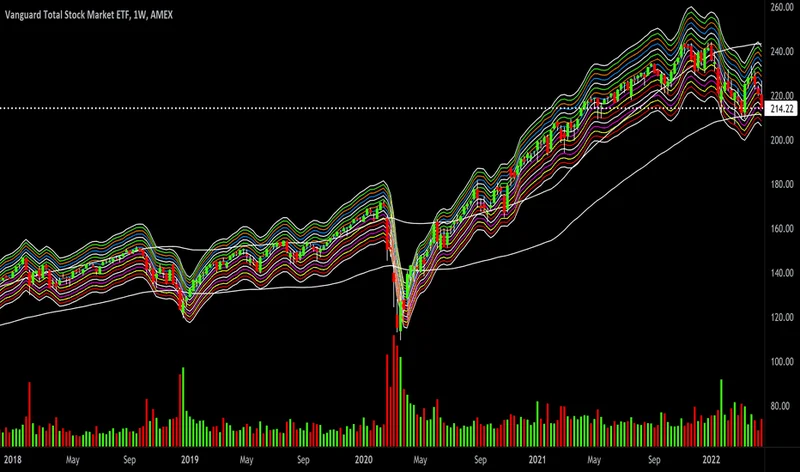

Neutral rating based on the "overall summary"? What does that even MEAN? It's like saying the weather is "sort of sunny, sort of cloudy." Thanks for the insightful analysis, Captain Obvious. And a "Sell" rating based on the moving average consensus? Wow, groundbreaking. Moving averages. The financial world's version of reading tea leaves.

Trading at $323.80, compared to its 50-day exponential moving average of $327.30, indicating a Sell signal. I'm not sure what's worse, the fact that people actually use this stuff to make decisions or that someone is charging them money for it.

The price forecast of $392.91 implies an upside of 21.3%. Based on what? Hope and fairy dust? Analysts are paid to be optimistic. Their job is to pump stocks, not to provide realistic assessments. I'd trust my cat's investment advice before I'd trust a Wall Street analyst.

And the stocks with the highest upside potential? FAT Brands (FAT), Jupiter Neurosciences (JUNS), Cibus (CBUS), NRX Pharmaceuticals (NRXP), Direct Digital Holdings (DRCT). Never heard of 'em. Sounds like a list of penny stocks my uncle would pitch me at Thanksgiving dinner.

VTI ETF’s Smart Score is seven, implying that this ETF is likely to perform in line with the broader market. Well, offcourse, if it's weighted towards the same big tech stocks that drive the broader market indexes anyway.

Wait a minute... Caterpillar (CAT) is up over 56% year-to-date? Now that's interesting. A heavy-duty construction machinery company beating the VTI and VOO? That's like the nerdy kid in class suddenly becoming the star quarterback. Goldman Sachs (GS) too, huh? Up 36% YTD. Okay, maybe there's something to be said for looking beyond the usual suspects. Are we finally seeing some value rotate back into the old-school industrials and financials? Maybe. Or maybe it's just a dead cat bounce. Who knows?

But a sales growth rate of around 6% for CAT seems easily doable, especially as buyers better appreciate its digital technologies... Digital technologies? On a bulldozer? What is this, a Transformers movie? I swear, every company these days is trying to rebrand itself as a tech company.

Look, VTI ain't a scam, exactly. It's just... vanilla. Overhyped. It gives the illusion of diversification without actually delivering it. You're basically paying a premium to own the same overvalued tech stocks that everyone else owns. If you're looking for real diversification and alpha, you're gonna have to dig a lot deeper than this.